Your sales team celebrates a big renewal. Three weeks later, that same customer is gone. No warning. No complaints. Just silence, then a cancellation email.

This happens constantly. According to Express Analytics, the average business loses 20-30% of customers annually in competitive industries. Most never see it coming because they're watching the wrong signals.

Here's what surprised me after watching dozens of companies try to solve this: the customers who complain aren't your biggest risk. The ones who go quiet are. And by the time you notice the silence, they've already made their decision.

The $136 Billion Blindspot

U.S. companies lose $136.8 billion per year due to avoidable consumer churn, according to the CallMiner Churn Index reported by Forbes. That's not total churn. That's the preventable kind—customers who would have stayed if someone had noticed the warning signs.

The old logic was simple: watch for complaints. Unhappy customers tell you they're unhappy. Then you fix the problem.

That logic is broken. Most customers don't complain. They just leave. By the time they reach out to cancel, they've already found your replacement. The conversation isn't a negotiation—it's a notification.

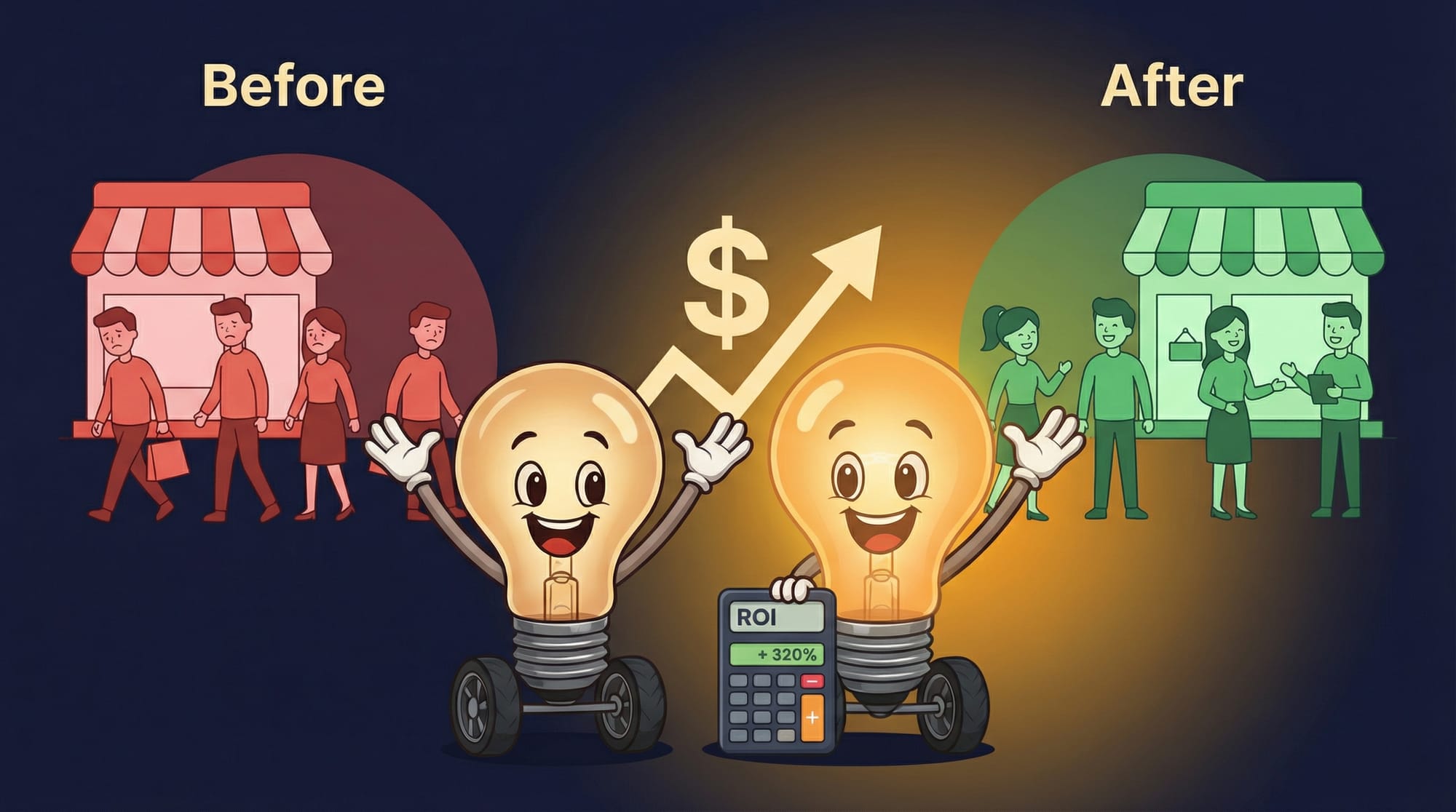

Research from Express Analytics shows that reducing churn by just 5% can increase profits by 25-95%. That's not a typo. The range is huge because it compounds: retained customers buy more, cost less to serve, and refer others. Losing them costs you the customer and everyone they would have brought.

What Does Churn Actually Cost You?

Acquiring a new customer costs 5x as much as retaining an existing one. Most business owners know this. Fewer realize what it does to their metrics.

As Gainsight's analysis points out, churn directly increases Customer Acquisition Cost (CAC) and erodes Net Revenue Retention (NRR). These are the two metrics investors and lenders actually care about. High churn doesn't just hurt today's revenue—it makes your business structurally weaker.

There's also the hidden operational cost. Gainsight notes that churn leads to operational inefficiencies, forcing teams to constantly react to problems instead of proactively driving success. Your customer success team becomes a fire department instead of a growth engine.

I've seen this pattern across dozens of implementations: companies with high churn can't plan. Every quarter is a scramble to replace what they lost. Companies with low churn can invest in growth because their foundation is stable.

Why Do Traditional Warning Signs Fail?

Traditional customer health scoring methods rely on partial datasets or manual scoring, according to Sturdy.ai's research. This produces delayed or incomplete insights.

Think about what you're actually tracking. Usage data, maybe. Support tickets, sometimes. But what about the tone of those support conversations? The emails your sales rep exchanged three months ago? The Slack messages in your shared channel?

Most churn signals hide in unstructured data: emails, support tickets, chats, meeting transcripts, survey responses. Sturdy.ai found that effective customer health scoring requires consolidating all of this with your structured CRM and usage data.

Here's the problem: humans can't do this at scale. You might notice that one big account feels different lately. You won't notice the pattern across 500 accounts that tells you 47 of them are about to leave.

This is where AI changes the game. Not because it's magic, but because it can process signals humans can't track. As Braze puts it, predictive modeling has made it possible to identify customers at risk of churning before they turn into lost customers—giving brands the opportunity to act fast.

If you're exploring how AI can improve your operations, churn prediction is one of the highest-ROI applications. The math is simple: saving one enterprise customer often pays for an entire year of prediction tooling.

The 30-Day Early Warning System

AI-powered systems can predict customer behavior 45 days before they churn, according to Kunko Agency's retention research. That's not theory—that's the lead time you get when you consolidate the right signals.

Here's how to build a system that actually works:

Step 1: Consolidate Your Customer Signals

Express Analytics identifies the key components of churn prediction: customer behavior analysis, historical transaction data, engagement metrics (emails opened, app usage, support tickets), and demographics/segmentation.

Start by listing every touchpoint you have with customers:

- Product usage data (logins, feature adoption, session duration)

- Support interactions (ticket volume, resolution time, sentiment)

- Communication patterns (email opens, response times, meeting attendance)

- Billing signals (payment delays, plan changes, discount requests)

- Relationship indicators (NPS scores, survey responses, referral activity)

Most companies have 60-70% of this data scattered across 5-10 different systems. The first win is getting it into one place.

Step 2: Build Behavioral Baselines

A customer logging in twice a week might be healthy. Or it might be a 50% drop from their normal pattern. You can't know without a baseline.

For each customer segment, establish normal ranges for:

- Login frequency and session duration

- Feature usage breadth (how many features they touch)

- Support ticket volume and sentiment

- Response time to your outreach

- Expansion signals (new users added, feature requests)

RFM analysis (Recency, Frequency, Monetary value) can create 12 customer segments with personalized journeys for each, according to Kunko Agency. Different segments have different healthy patterns.

Step 3: Set Trigger Thresholds

Once you have baselines, define what deviation triggers concern:

- Yellow alert: 25% drop from baseline over 2 weeks

- Orange alert: 40% drop or multiple yellow signals

- Red alert: 60% drop or critical event (support escalation, executive complaint)

The specific numbers matter less than having them at all. You'll calibrate over time based on what actually predicts churn in your business.

Step 4: Automate Intervention Workflows

Prediction without action is just expensive observation. For each alert level, define what happens:

- Yellow: Automated check-in email + CSM notification

- Orange: CSM outreach within 48 hours + executive briefing

- Red: Same-day executive call + retention offer authorization

Ask-AI's research shows that AI-powered intelligent self-service can resolve up to 30% of tickets automatically. Some early-stage interventions don't need humans at all—the system can trigger helpful content, proactive check-ins, or usage tips that address common friction points.

What Happens When the Model Gets It Wrong?

Here's the scenario nobody talks about: Tuesday morning, your CSM gets an alert that a major account is at high churn risk. They call. The customer is confused—everything's fine, they're just busy this quarter.

Now you've created awkwardness. The customer wonders if you're desperate. Your CSM feels foolish. The sales team questions whether the whole system is worth it.

This happens. Prediction models aren't perfect. In my experience building these systems, you should expect:

- False positive rate of 15-25% (flagged customers who weren't actually leaving)

- False negative rate of 10-15% (missed customers who did leave)

- 3-6 months of calibration before the model reflects your specific business

Build your intervention scripts to handle false positives gracefully. "We noticed you haven't used [feature] lately and wanted to check if there's anything we can help with" works whether they're at risk or just busy.

How Do You Know the System Is Working?

You need to track this like any other business system. Here's what to measure:

- Churn rate before vs. after implementation (give it 2 quarters minimum)

- Prediction accuracy: % of flagged accounts that actually churned within 90 days

- Intervention success rate: % of flagged accounts saved after outreach

- Time to detection: average days between first warning signal and intervention

- False positive rate: % of alerts that turned out to be nothing

- CSM efficiency: accounts managed per CSM with vs. without the system

If you're not seeing at least a 15-20% improvement in retention within 6 months, something's wrong with either your data inputs, your threshold calibration, or your intervention playbook.

The companies I've seen succeed with this don't just implement and forget. They review predictions monthly, adjust thresholds quarterly, and add new signal sources as they discover them.

For teams serious about building AI-powered revenue systems, churn prediction is often the second implementation after lead scoring. Same infrastructure, different direction—one predicts who will buy, the other predicts who will leave.

The Hidden Costs of Churn Prediction

Nobody tells you this part. Churn prediction systems work, but they come with tradeoffs:

- Data infrastructure investment: You need clean, consolidated customer data. Most companies spend 60-70% of project time on data plumbing, not model building.

- False positive fatigue: Too many wrong alerts and your team stops trusting the system. Calibration takes months of attention.

- Intervention capacity: Predicting churn is useless if you don't have CSMs available to act on alerts. Budget for increased outreach volume.

- Customer perception risk: Poorly timed "are you thinking of leaving?" outreach can plant ideas customers didn't have. Scripts matter.

- Maintenance burden: Models drift. Customer behavior changes. Expect 5-10 hours monthly to keep the system calibrated.

- Integration complexity: Your CRM, support system, product analytics, and billing system all need to talk to each other. Most don't out of the box.

The companies that succeed budget for these costs upfront. The ones that fail treat churn prediction as a software purchase rather than an operational capability.

Is This Worth It for Your Business?

Churn prediction makes sense when:

- Your customer lifetime value exceeds $5,000 (below this, manual intervention costs more than churn)

- You have at least 200 customers (smaller bases don't generate enough pattern data)

- Your churn rate exceeds 10% annually (if it's lower, other investments may yield more)

- You have CSM capacity to act on alerts (prediction without action is waste)

If you're not there yet, start simpler. Track the five key signals manually for your top 20 accounts. Build the muscle before you build the machine.

If you're evaluating AI implementation more broadly, churn prediction often ranks in the top three use cases for ROI. The math is compelling: one saved enterprise customer can fund the entire system for a year.

Key Takeaways

- U.S. companies lose $136.8 billion yearly to preventable churn—customers who would have stayed if someone noticed the warning signs 30-45 days earlier.

- Traditional health scoring fails because it relies on partial data and manual updates. AI consolidates signals from usage, support, email, and billing that humans can't track at scale.

- Reducing churn by just 5% can increase profits by 25-95% because retained customers compound: they buy more, cost less, and refer others.

- Expect 15-25% false positive rates and 3-6 months of calibration. Build intervention scripts that work whether the customer is actually at risk or just busy.

- Start with data consolidation, not model building. Most implementations spend 60-70% of time on data plumbing because signals are scattered across 5-10 systems.

Frequently Asked Questions

How much data do I need before AI churn prediction works?

You need at least 200 customers and 12 months of historical data to establish meaningful patterns. Below this threshold, statistical models can't distinguish signal from noise. Start with manual tracking of your top accounts while you accumulate data.

What's the difference between churn prediction and customer health scoring?

Customer health scoring is a snapshot—how is this account doing right now? Churn prediction is forward-looking—what's the probability this account leaves in the next 30-90 days? Prediction models use health score trends over time, not just the current state.

Can small businesses use AI for churn prediction?

Yes, but the economics shift. If your average customer is worth $500/year, you can't afford $200/month in tooling plus CSM time for interventions. Start with simple rules: flag any customer whose usage dropped 50% month-over-month. Graduate to AI when customer values support it.

How do I avoid annoying customers with retention outreach?

Frame outreach as helpful, not desperate. "We noticed you haven't tried [new feature]—want a quick walkthrough?" works better than "We noticed you're using us less—is everything okay?" The goal is adding value, not fishing for complaints.

What tools actually work for churn prediction?

Platform-native tools (Gainsight, ChurnZero, Totango) work well for SaaS. For custom implementations, you'll need a data warehouse (Snowflake, BigQuery), a customer data platform (Segment, RudderStack), and either a pre-built ML model or data science resources to build one.